Ferrari’s share price has slid sharply following today’s presentation and investor updates, with the share price down 15 per cent at the time of writing. The decline came despite the company lifting annual guidance and laying out ambitious long-term revenue and profit targets.

Investors appeared to react to signals that Ferrari has pulled back expectations for its electric vehicle transition. The company announced it would slash itsfully electric model mix target from 40 % to 20 % by 2030, putting greater emphasis back on hybrid and combustion models.

CarExpert is at the brand’s investor day and there appears to be some agitation from investors that Ferrari is hedging its bets on battery technology, concerned about execution risk or cost pressures in going fully electric too fast. The shift, while logical in context that Ferrari buyers may not be ready for EVs, may have shaken confidence among more aggressive EV-focused investors.

Ferrari CEO Benedetto Vigna addressed the share price slide by noting that it cannot commit to sell EVs when the market does not want them “I mean, we cannot, we cannot commit to something that then we are not able to do”.

Ferrari’s financial update story below:

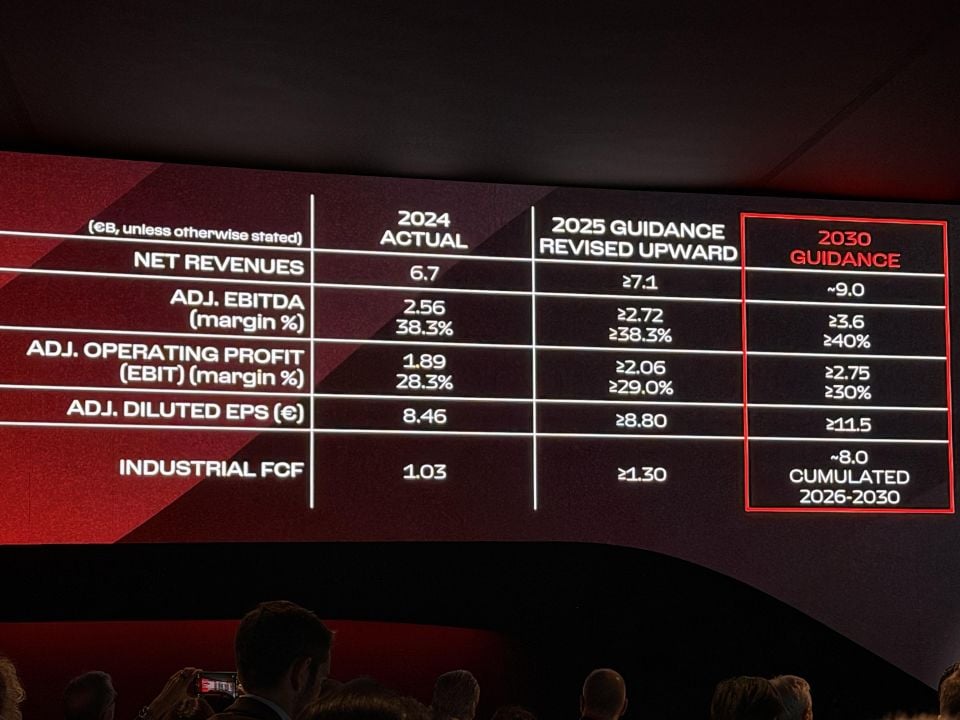

At the company’s 2025 Ferrari Capital Markets Day, chief financial officer Antonio Picca Piccon confirmed that Ferrari had already exceeded the 2026 financial targets set at its previous Capital Markets Day and would enter 2025 ahead of plan. Order visibility now extends into 2027, underscoring demand that continues to exceed supply.

By 2030, Ferrari expects revenue of around €9.0 billion (A$15.93 billion), up from approximately €6.0 billion (A$10.62 billion) today. The company is targeting an EBIT margin of roughly 30 per cent and an EBITDA margin near 40 per cent, levels consistent with the world’s most profitable luxury brands. Over the 2024–2030 plan period, Ferrari anticipates generating industrial free cash flow exceeding €8.0 billion (A$14.16 billion).

Total capital expenditure for the same period will amount to €4.7 billion (A$8.32 billion), of which 80 per cent will fund new product innovation and 20 per cent will support infrastructure projects, such as the new e-Building in Maranello and upgraded paint facilities. This is separate from Ferrari’s annual R&D operating expenditure, which is expected to remain around seven per cent of annual revenue — equivalent to roughly €630 million (A$1.12 billion) in 2030 — as the company continues to invest in next-generation vehicle architectures, software, and electrification.

Picca Piccon said Ferrari’s investment approach remains “disciplined and forward-looking,” ensuring each euro spent directly supports long-term product development rather than short-term volume growth.

Production will remain deliberately limited, with more than 85 per cent of sales coming from core range models and less than 15 per cent from Icona and Special Series (e.g. 296 Speciale) lines. This balance supports Ferrari’s pricing power and order backlog, which now stretches beyond two years for most models.

The company’s personalisation business, encompassing bespoke finishes and custom components, now contributes about 19 per cent of car and parts revenue, making it one of Ferrari’s most profitable divisions. Management expects this share to grow further as personalisation becomes increasingly central to the Ferrari ownership experience.

Ferrari plans to maintain a 40 per cent dividend payout ratio from 2025 onward and expects to distribute €3.5 billion (A$6.20 billion) in dividends and an additional €3.5 billion (A$6.20 billion) in share buybacks between 2027 and 2031. Combined, those shareholder returns total €7.0 billion (A$12.39 billion), representing more than 85 per cent of projected industrial free cash flow. The company aims to reach a net cash position before 2030.

Despite rising investment in electrification, Ferrari’s profitability is expected to remain stable. The company has already factored in the upcoming 15 per cent US import tariff and does not expect a significant impact on margins or pricing.

Picca Piccon said Ferrari’s financial foundation allows it to fund innovation entirely from its own cash generation, without compromising returns or requiring external capital.

As Ferrari prepares to launch its first fully electric model in 2026, the brand enters its next chapter with a balance sheet stronger than at any point in its history.

Ferrari 2030 Financial Outlook

| Category | Target / Projection |

|---|---|

| Net Revenue (2030) | €9 billion (~A$15.9 billion) |

| EBIT Margin | ≈ 30 % |

| EBITDA Margin | ≈ 40 % |

| Industrial Free Cash Flow (2024–2030) | > €8 billion (>A$14.2 billion) |

| CapEx (2024–2030) | €4.7 billion (~A$8.3 billion) |

| CapEx Allocation | 80 % product innovation / 20 % infrastructure |

| R&D Intensity | ~ 7 % of annual revenue |

| Post-2030 Product Investment | 40 % of current CapEx |

| Dividend Payout Ratio | 40 % from 2025 |

| Shareholder Returns (2027–2031) | €3.5 b dividends + €3.5 b buybacks (~A$6.2 b + A$6.2 b) |

| Cash Position Goal | Net cash before 2030 |

| Personalisation Revenue Share | ~ 19 % of car + parts revenue |

| Production Mix | > 85 % range models, 10% special series 5 % Icona |

| Order Book Visibility | Into 2027 |

| Tariff Impact (US) | 15 % import tariff accounted for; minimal profit effect |